Leverage is one of the most powerful — and dangerous — tools in a trader’s arsenal. When used right, it can multiply your gains. When used wrong, it can blow your account in minutes.

Whether you’re trading Forex, Futures, or Crypto with a prop firm like Top1Funded, understanding leverage is non-negotiable. In this blog, we break down what leverage is, how it works, and the hidden risks most traders overlook.

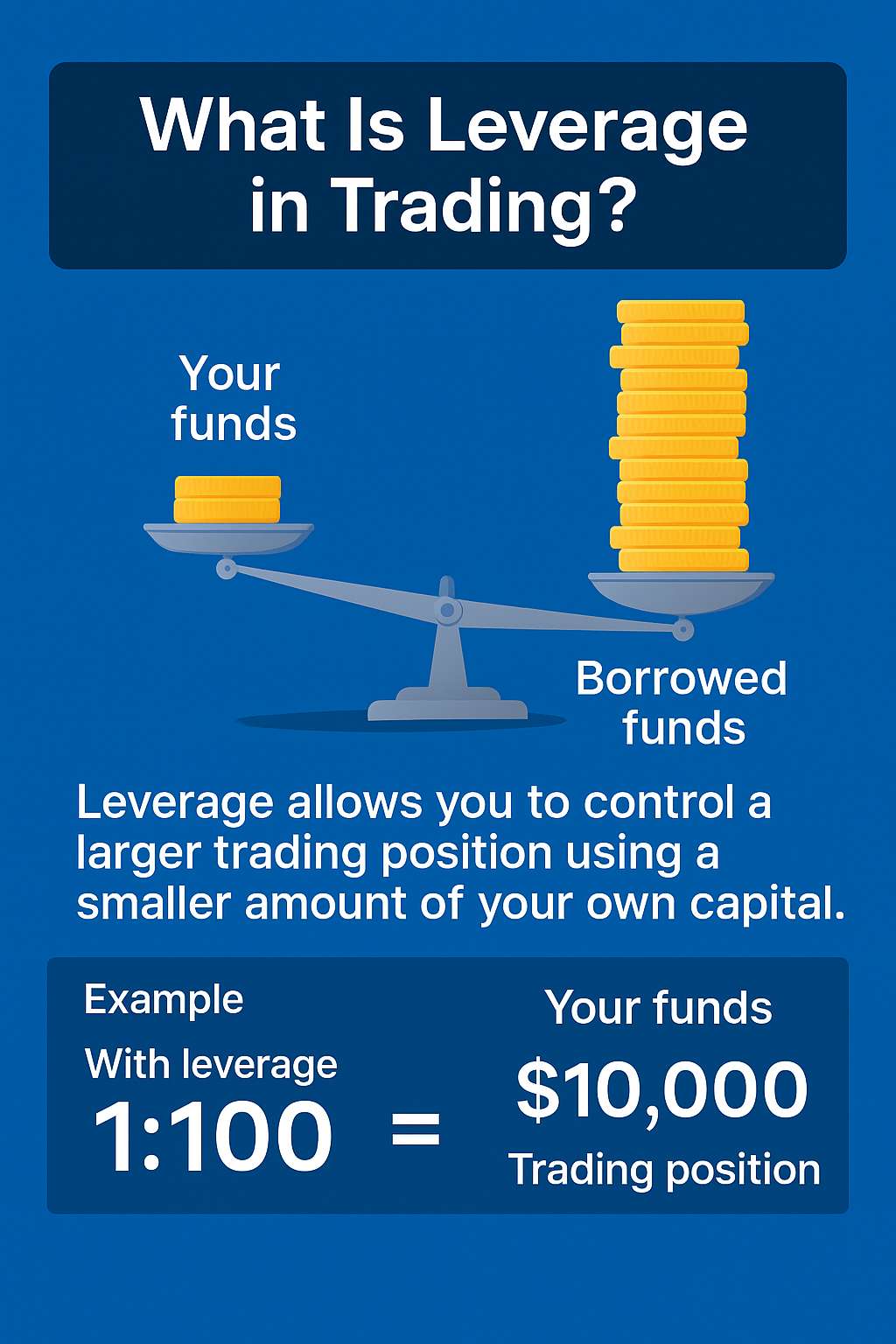

📈 What Is Leverage in Trading?

Leverage is borrowed capital that allows you to open larger positions than your account balance would normally allow.

For example, with 10:1 leverage, a $1,000 account can control a $10,000 trade.

Prop firms — like Top1Funded — give traders access to large leverage so they can scale results without using personal capital.

✅ The Benefits of Leverage

Leverage can work for you if you know how to control it.

1.

Higher Profit Potential

Even small market moves can turn into large gains if you’re trading with size.

2.

Capital Efficiency

You don’t need $50K in cash to control $50K worth of trades.

3.

Access to Bigger Opportunities

Leverage allows you to trade higher timeframes, larger moves, or multiple instruments — without tying up all your capital.

⚠️ The Hidden Risks of Leverage

Most traders only see the upside — but leverage magnifies risk too.

1.

Faster Losses

The same leverage that multiplies profits will multiply your losses just as fast.

A 1% market move against a 100:1 leveraged position = account gone.

2.

Tighter Margin for Error

Leverage leaves no room for sloppiness. One emotional trade or missed stop loss can breach your prop firm limits — even if your strategy is solid.

3.

Overconfidence

Traders often confuse amplified results with skill. Leverage can trick you into thinking you’re crushing it — until the market humbles you.

🧠 How Prop Firm Traders Should Use Leverage

At Top1Funded, we fund traders across Forex, Futures, and Crypto, each with different leverage setups. Here’s how to handle it smart:

✅ Use leverage to scale, not to gamble

Focus on high-probability setups. Leverage is the gas pedal — but don’t hit it with your eyes closed.

✅ Know your prop firm’s rules

Every firm has different max drawdown, daily loss, and scaling rules. If you ignore them, leverage becomes a weapon against you.

✅ Smaller lot size = longer survival

Want to pass your evaluation? Use less than the max. Consistency > big swings.

At Top1Funded, we design leverage with your survivability in mind — because we want traders to succeed long-term, not just for one lucky day.

🔥 Final Word: Leverage Is a Tool, Not a Shortcut

The best traders don’t use leverage to feel powerful — they use it strategically. If you respect it, it opens doors. If you abuse it, it slams the door shut.