unlock a real live funded account with 90% profit share

The Only Prop Firm Paying

Futures Traders In Evaluation Phase

Have you ever heard of a prop firm that pays you up to $21,000… just in the evaluation phase?

At Top 1 Funded — We Do! Earn Real Payouts in Every Phase of the Evaluation

Top1funded

4.6

21 Reviews

I had a truly seamless experience with…

I had a truly seamless experience with Top1funded. The onboarding was transparent, setup was quick, and funding arrived exactly as promised. Their customer support was knowledgeable, responsive, and guided me through each step—highly recommended!

I completed the challenge and received…

I completed the challenge and received my payout within days. The entire process was smooth and hassle-free. Definitely one of the best firms I’ve worked with!

One of the most transparent and…

One of the most transparent and trader-friendly prop firms out there. The spreads are low, and they actually seem to care about your success. Highly recommended!

As Seen On

and over 250 trusted news platforms worldwide.

Trusted By 10,000+ Traders

24/7 Support

No Hidden Rules

First Payout Instantly

Based in USA

$12M in Payouts Processed and Growing

Multiple Trading Platforms.

Scale Up to $1M

Top1Funded Futures Program

Forget slow paths to get funded, most futures firms make you wait for payouts-not here.

At Top 1 Funded, you get paid during evaluation-because your time and skill deserve more.

- No monthly fees, No minimum trading days. just real payouts while you prove your skills.

- Paid evaluation with real earnings,Earn up to $21,000 during the evaluation phase alone — depending on your account size and performance

- This isnt a grind to the top model. Its about proving you can trade-and getting paid while you do it every step of the way.

Pass the evaluation phase and unlock a real live funded account with real execution (Not Simulated)

Features

Why Traders Choose Top1Funded Over the Rest

| Features |  |

Other Prop Firms |

|---|---|---|

| Paid Evaluations | ||

| No Minimum Trading Days | ||

| Paid Even If You Breach | ||

| No Hidden Rules | ||

| US Traders Accepted | ||

| Real Live Market | ||

| 24/7 Live Support | ||

| Based in U.S.A. | ||

| No Monthly Fees |

Built For Traders Who Want To Earn Before They’re Funded

If you’re looking for payouts during evaluation, no hidden rules, and real capital — this program was built for you.

- Real payouts during evaluation

- Transparent, phase-based structure

- Guaranteed payouts on earned profits, even if you breach your live accounts

- No monthly fees, no activation fees.

- Real Live Market (Not Simulated)

- Static Drawdown on live account.

Unlock Payouts In Every Phase

Earn $3500 to $21,000 in Evaluation Phases 1–4 — Before Unlocking Your Live Funded Account

Move From Paid Evaluation To A Real Live Funded Account

Keep 90% Of Your Profits With No Consistency Rules — And Earn Your Financial Freedom

Evaluation Rules

| Account Size | Target (9%) | Max. Loss | Time Limit |

|---|---|---|---|

| $25K | $2,250 | $1,500 | 60 Days |

| $50K | $4,550 | $2,500 | 60 Days |

| $100K | $9,000 | $5,000 | 60 Days |

| $150K | $13,500 | $7,500 | 60 Days |

25% Consistency Rule Only In Evaluation Phase

Payouts During Evaluation

| Account Size | Phase 1 | Phase 2 | Phase 3 | Phase 4 | Total Payouts |

|---|---|---|---|---|---|

| $25K | $500 | $750 | $750 | $1,500 | $3,500 |

| $50K | $1,000 | $1,500 | $1,500 | $3,000 | $7,000 |

| $100K | $2,000 | $3,000 | $3,000 | $6,000 | $14,000 |

| $150K | $3,000 | $4,500 | $4,500 | $9,000 | $21,000 |

Evaluation Rules

| Account Size | Static Max Loss | Profilt Split |

|---|---|---|

| $25K | $1,500 | 90% |

| $50K | $3,000 | 90% |

| $100K | $6,000 | 90% |

| $150K | $9,000 | 90% |

- No Consistency Rule

- Static Drawdown

How It Works?

1

Choose Your Program & Account size below

2

Get Paid After Each Evaluation Phase (1–4)

3

Go Live, Trade, Withdraw,

Repeat

Choose Your Account Size

All Plan Includes :

- All Evaluation Fees Are One-Time Payments. No Monthly Fees Or Activation Fees.

- No Minimum Trading Days — Stay Active By Placing At Least One Trade Every 14 Days During Evaluation, And Every 7 Days Once Funded.

- Payouts after every successful phase

- Access to R|Trader via Rithmic

- No hidden rules, no strategy restrictions

- Static drawdown model In Live Funded account / Eod trailing in Eval

- Premium trader support

Officially supported platform: R|Trader Pro. Rithmic login may be used with NinjaTrader, TradingView, Quantower, Bookmap and others that are Rithmic-compatible. but we do not provide support for third-party platforms as of now.

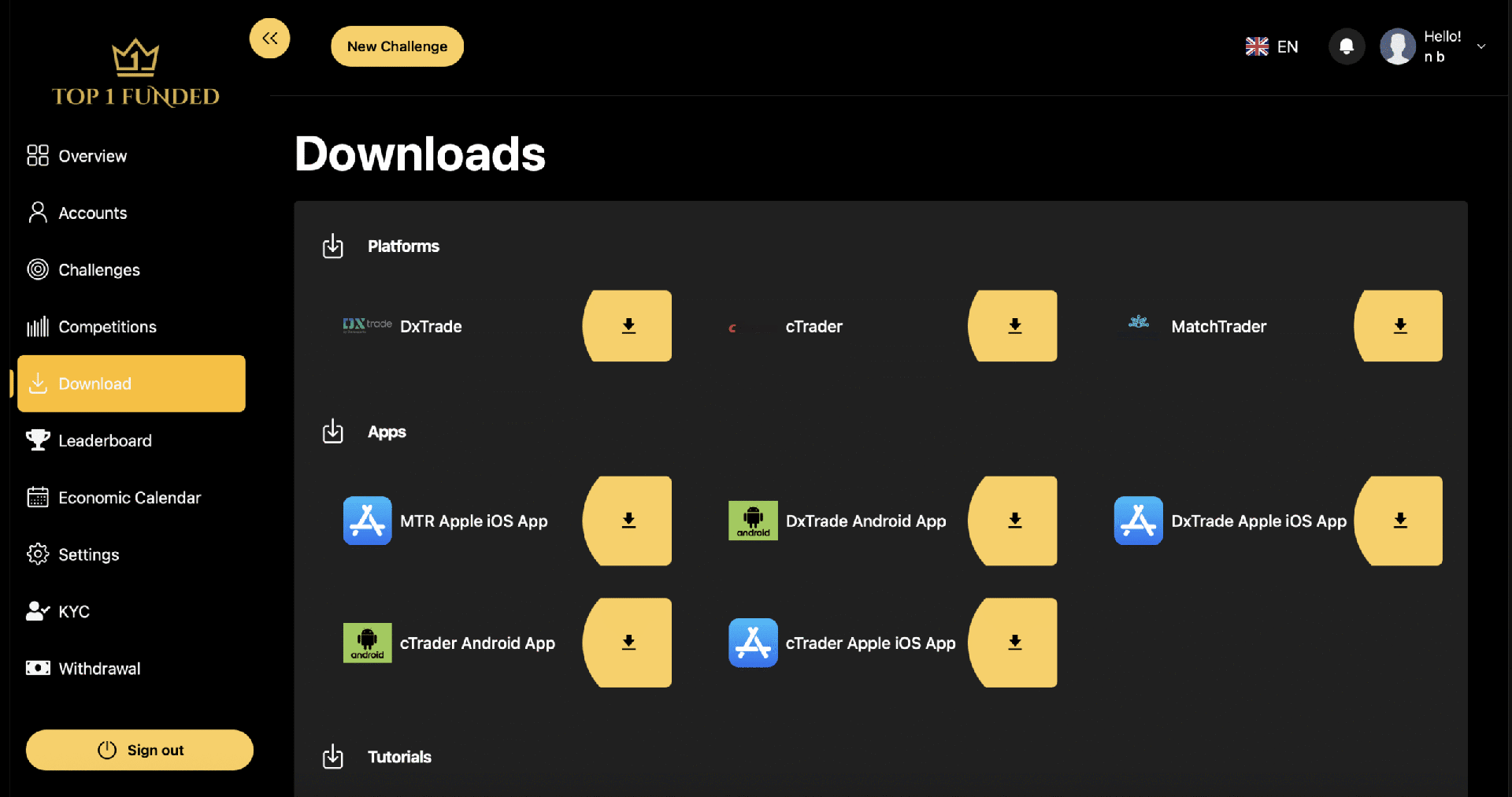

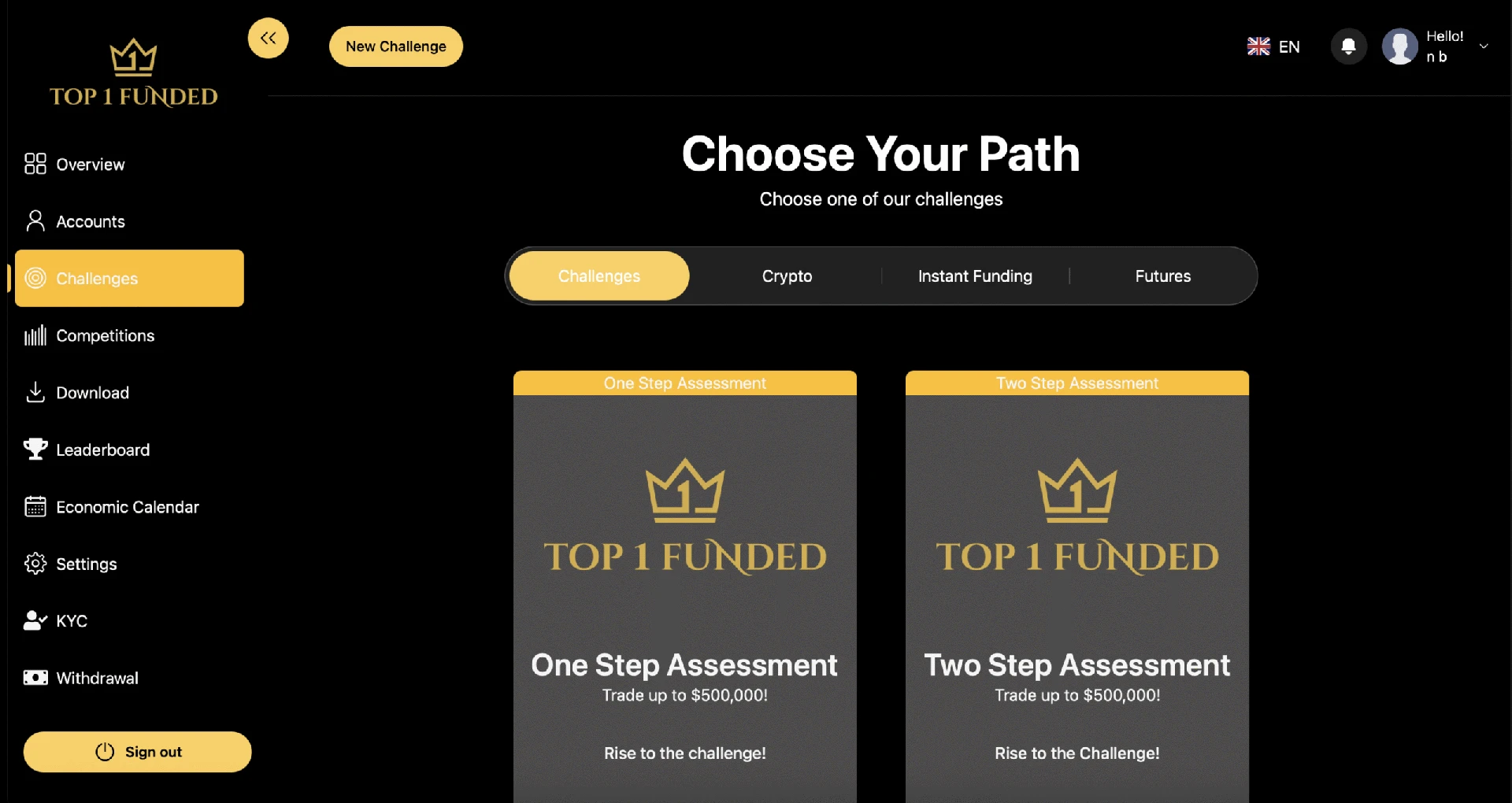

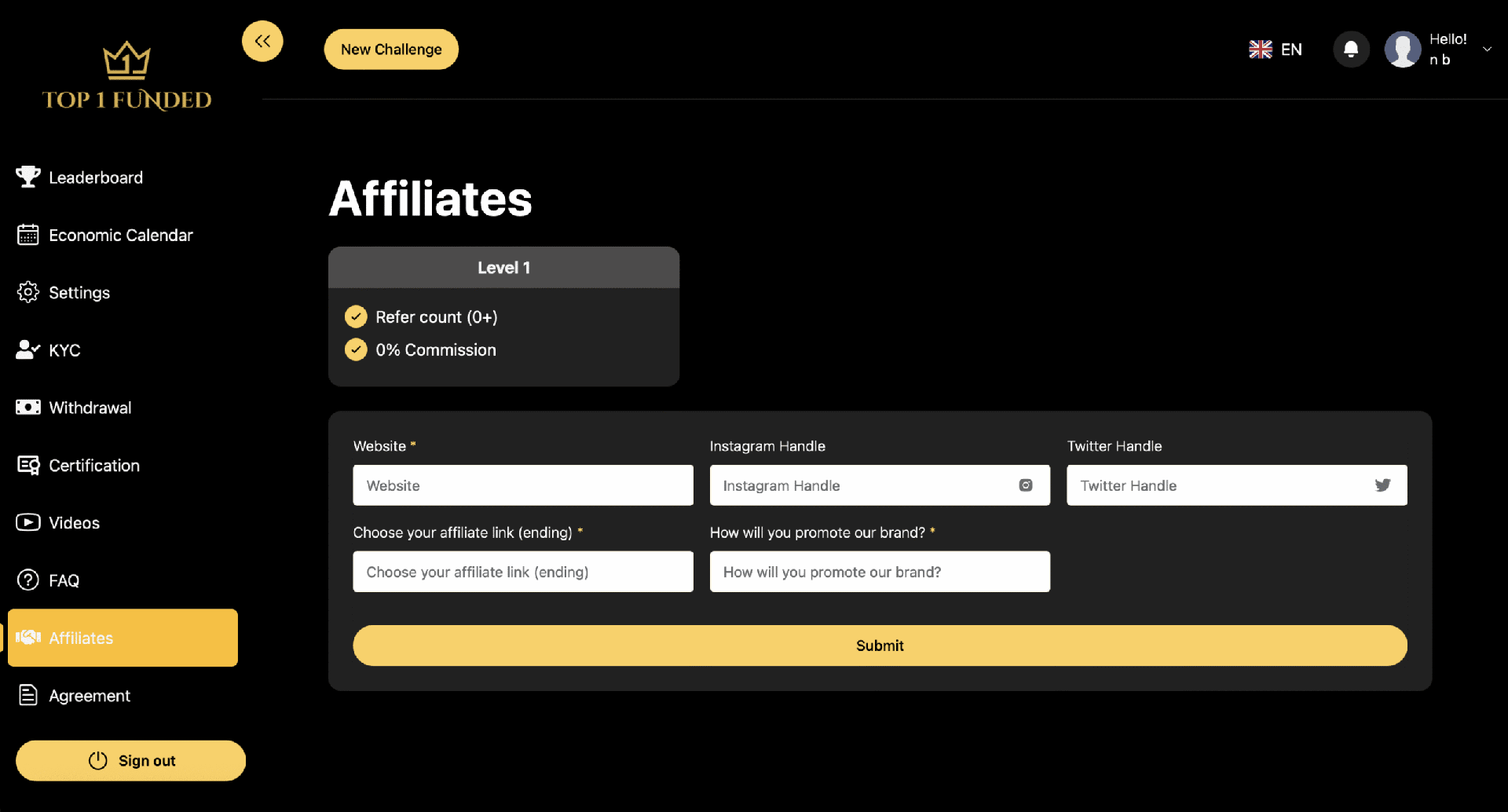

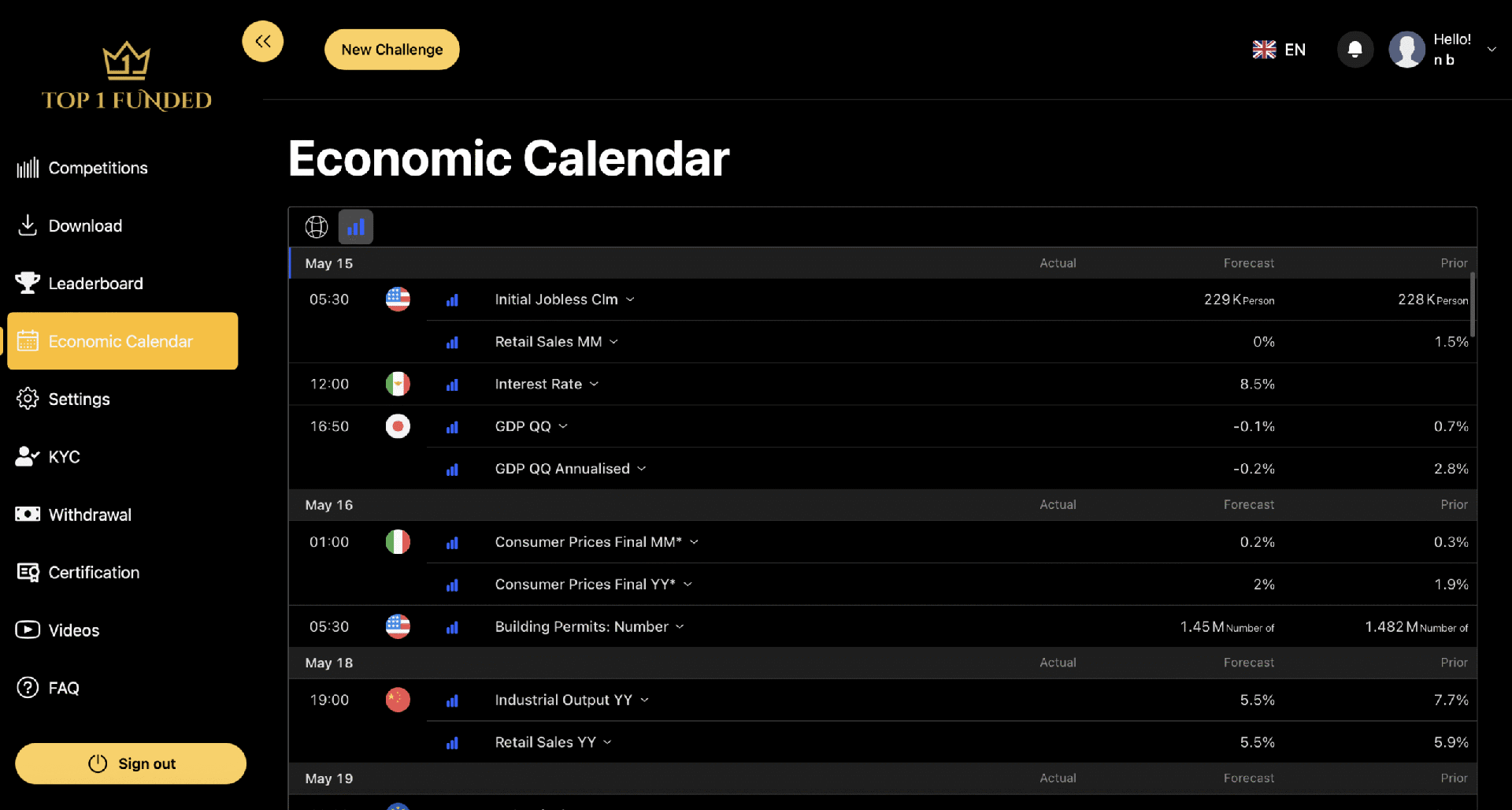

A Dashboard Built for Traders, by Traders

Our modern trader dashboard includes built-in economic calendars,

competition tracking, payouts, Platforms, and more — so you’re always one step ahead.

Start Trading Futures.

Get Paid From Day One.

Certificates of Withdrawal

Your Trader Knowledge Hub

Educational Blogs, Insights, And Trading Strategies To Help You Get Funded, Stay Funded, And Level Up Your Journey

TOP 1 Funded Details & FAQ

Learn more about using an Top1Funded Platform.

Phase 1 begins once you purchase an account. Once you hit your profit target; while maintaining a 25%

consistency, you will be able to request a payout and then advance to the next Phase. At each new

Phase your account will begin with a fresh starting balance.

Once you complete a Phase and meet the 25% consistency rule you will be eligible to make a request for

that Phase’s payout. You will not be able to advance to the next phase until the payout is requested and

completed.

We have a Consistency Requirement to ensure traders aren’t hitting profit targets through a few lucky

trades. This promotes consistent behavior and punishes YOLO style trading. The calculation is: (best

trading day PnL/Total PnL) x 100.

A lower value means profits are generated more consistently across multiple trading days. A higher

value means profits are concentrated on fewer trading days. For example, a consistency requirement of

25% means you cannot achieve your entire profit target in less than 4 days (100% / 25% = 4).

You must meet both the profit target and the consistency requirement — maintaining a consistency ratio at or below 25% — to hit your profit target, be eligible for a payout, and to advance to the next phase.

•Example 1: On a $100k account with a profit target of $8,000, if you earn $2,000 per day over 4 days,

you meet the consistency requirement. Your best day is $2,000, and total profit is $8,000 — resulting in

a consistency ratio of 25% ($2,000 / $8,000).

•Example 2: On a $100k account with a profit target of $8,000, if your profits across 4 days are $3,000,

$1,000, $2,000, and $2,000, you violate the consistency requirement. Your best day is $3,000, and total

profit is $8,000 — which gives a consistency ratio of 37.5% ($3,000 / $8,000). To meet the consistency

requirement of 25%, you would now need to reach a total profit of $12,000 while keeping your best day

at or below $3,000.

No. But in order to complete the phase and be entitled to receive the payout, you will need to achieve both the profit target and the consistency requirement.

This is the predetermined profit amount you need to achieve in order to pass to the next phase of the program and be eligible to receive the payout.

There is no specific Daily Loss Limit, but traders must always stay within the Max Trailing Loss.

The Maximum Trailing Loss for each phase trails using End of Day Balance. Example: If your starting

balance is $100,000, and there is a 5% Max Trailing Loss, you can drawdown to $95,000 before you

violate the Maximum Trailing Loss rule. Then for example let’s say you take your end of day balance to

$102,000. This is your new End of Day High-Water Mark, which would mean your new Maximum Trailing

Loss would be $97,000. Once you generate a 5% return in the account, the Max Trailing Loss will lock at

the starting balance (i.e. the Max Loss Limit will never increase above your starting balance). For the

purpose of all calculations, the end of day is defined as 1600 CST.

No. You will need to purchase a new account if you breach it for any reason.

No. All positions must be closed and all open orders cancelled at 1510 CST each weekday.

A futures contract represents a standardized amount of an underlying asset. For example, one E-mini

S&P 500 futures contract (ES) represents $50 times the index price, while one crude oil (CL) contract

represents 1,000 barrels of oil. See the attached product table in Appendix A.

You must complete the CME market data attestation using the R | Trader Pro desktop app—this cannot

be done through mobile or web platforms. Once you’ve completed the attestation in R | Trader Pro,

you’ll be able to log in and trade through mobile or web apps. Please note: you must attest as a non-

professional; we do not accept professional status in this program.

Market data fees cover the cost of accessing real-time price data from the exchanges. These fees are

included in your purchase price during Phases 1 through 4. Once you reach the Live Funded Futures

phase, any applicable market data or platform fees will be deducted from your account balance on a

monthly basis.

Each Phase (1-4) has a maximum time limit of 60 calendar days. This means you must meet all the

requirements for a given phase within 60 days of starting that phase.

If you do not complete a phase within the 60-day window, your account will be deactivated, regardless

of your progress or profit level at that point. You will need to purchase a new Futures plan to continue.

The timer begins on the day you place your first trade and continues uninterrupted. There are no extensions or pauses.

Please plan your trading accordingly to stay on track throughout all four phases.

For Phases 1-4, you must place an executed trade once every 14 days to retain the account.

If you reach the Live Funded account level, you must place an executed trade once every 7 days to retain

the account.

No, unfortunately we cannot pause the inactivity timer at any account phase.

You will be required to complete our Know Your Customer (KYC) program and sign our Trader

Agreement prior to requesting a payout.

If you do not pass the KYC process, your account will be closed.

No. We operate at arm’s lengths with the liquidity providers/Exchanges. All market pricing and trade

executions are provided by third parties and are not changed or modified by us. Additionally, we do not markup transaction costs established through adjusting bid-offer spreads, markups/markdowns,

commission charges or swaps.

During the simulated phases, trades are executed against the liquidity provided by your trading platform

and are designed to closely mimic real-market pricing and execution. Once you receive your live funded

account, the pricing and execution will come directly from the exchange(s) on which you trade.

The total number of contracts you can hold at one time is limited by both your account size and the exchange margin requirements for each product. Your account balance must be sufficient to cover the required margin for all open positions. Refer to Appendix A for a full breakdown of per-product margin

requirements.

If you have gains in your Live Funded Futures (Phase 5) account at the time of a breach, you will still receive your portion of those gains.

If you achieve the profit target for your current phase and meet the consistency requirements, you’ll be eligible to request that phase’s payout. This payout must be completed before your account is upgraded

to the next phase.

The Live Funded Futures account operates under a different set of rules compared to Phases 1-4. Once you reach this level, the following changes apply:

• Risk Parameters: The Max Loss is capped at 50% of your starting balance. There are no longer any profit targets, consistency rules, or time limits.

• Inactivity Rule: You must place at least one executed trade every 7 calendar days to retain your account.

• Live Market Conditions: You are now trading in a live environment, which means you may encounter real-market factors such as slippage, partial fills, and varying liquidity.

Subject to compliance with applicable laws and regulations, traders from all countries, excluding OFAC

listed countries, can take part in our program, unless otherwise limited at the Company’s discretion.

You must be at least 18 years of age, or the applicable minimum legal age in your country, to purchase an assessment.

Upon purchasing a Funded Futures plan, you will receive access to a trader dashboard where you can monitor your Funded Futures account. The dashboard is updated in near real time as we calculate your

account metrics. It is your responsibility to monitor your breach levels.

When you purchase a Funded Futures plan, you’ll receive credentials granting access to a Rithmic

R|Trader account. We provide the R|Trader Pro desktop application (Windows only). To use Rithmic’s

Web and Mobile platforms, you must first complete the Market Data attestation by logging into

R|Trader Pro desktop.

These credentials can also connect you to Rithmic’s data feed through supported third-party platforms

like Quantower, NinjaTrader, Bookmap, and others compatible with Rithmic.

Please note: While we facilitate access to Rithmic’s infrastructure, we do not offer user support for R|Trader, Rithmic, or any third-party platforms. For technical issues or platform-specific questions,

please contact the respective technology provider directly.

You may only have one active Funded Futures account per starting tier size at a time. The allowed tiers are $25K, $50K, $100K, and $150K—meaning the maximum number of active accounts you can hold at once is four, one of each size. Altogether, the combined starting balances of your active accounts cannot exceed $325,000.

Traders are allowed to trade Futures products only in this program, listed on the following exchanges: CME, COMEX, NYMEX & CBOT. The full list of supported Futures products is listed in Appendix A of this

document.

Traders must trade the front-month contract for each product, as it has the highest liquidity and open

interest. For example, in March, the correct contract for the ES E-Mini S&P 500 products is the March

(H) contract—not July (N) or September (U). Trading out-month contracts is prohibited and may result in

the loss of your account. Always ensure you’re trading the active front-month listed on the exchange.

To identify the most active front-month futures contracts, you can use CME Group’s Product Slate,

which provides detailed information on all available contracts, including their current front-month

status. https://www.cmegroup.com/markets/products.html

Trades can be placed starting at 1700 CST at the Globex Open and can be held until the 1510 CST session close.

Positions will be closed for you during regular trading days at 1510 CST. Trades cannot be held

over weekends.

During holiday trading hours, auto-liquidation will not occur at the half-time market close, and the trader

is responsible for closing the positions.

• Please pay careful attention to market hours around holidays and shortened weeks.

• Failure to close the positions before the market closes may result in the loss of the account whether it is a Funded Futures or Live Futures account.

Funded Futures accounts receive the same pricing and commissions as charged by the Liquidity

Provider/Exchanges to other, self-funded, retail trading accounts.

Please see Appendix A for details on per instrument commission charges.

Subject to our policy on Prohibited Trading as described below, you can trade using an automated strategy.

You are prohibited from using any trading strategy that is expressly prohibited by the Company or the

Liquidity Providers it uses. Such prohibited trading (“Prohibited Trading”) shall include, but not be

limited to:

● Exploiting errors or latency in the pricing and/or platform(s) provided by the Liquidity

Provider/Exchange

● Utilizing non-public and/or insider information

● Front running of trades placed elsewhere

● Trading in any way that jeopardizes the relationship that the Company has with a Liquidity

Provider/Exchange or may result in the canceling of trades

● Trading in any way that creates regulatory issues for the Liquidity Provider/Exchange

● Utilizing any third-party strategy, off-the-shelf strategy or one marketed to pass challenge accounts

● Attempting to arbitrage a funded account with another account with the Company or any third-party

company, as determined by the Company in its sole and absolute discretion.

●No Gambling Permitted: When participating in trading on both Challenge and Instant Funded Accounts,

traders are expected to adhere to responsible risk management practices. This includes carefully

considering the risks associated with position size, trade duration, and hedging strategies. Taking

excessive risks, such as utilizing maximum leverage to open large positions with the hope of reaching

profit targets through a single price movement, is strictly prohibited. Please refer to the Terms and

Conditions for the full Prohibition of Gambling Practices language.

● If the Company detects that your trading constitutes Prohibited Trading, your participation in the

program will be terminated and may include forfeiture of any fees paid to the Company. Additionally,

and before any Trader shall receive a funded account, the trading activity of the Trader under these

Terms and Conditions shall be reviewed by both the Company and the Liquidity Provider/Exchange to

determine whether such trading activity constitutes Prohibited Trading. In the case of Prohibited Trading,

the Trader shall not receive a funded account.

● Compliance with CME Group Rules: All trading activities must adhere to CME Group’s rules and

regulations.

● Additionally, the Company reserves the right to disallow or block any Trader from participating in the

program for any reason, in the Company’s sole and absolute discretion.

To view all Prohibited Uses, please review our Terms and Conditions here,

https://dashboardanalytix.com/client-terms-and-policies/

Our futures program does not prohibit trading during news events; however, traders must exercise

heightened caution due to the increased volatility and reduced liquidity that often accompany such events.

Traders are solely responsible for staying informed of scheduled economic news releases and managing

their positions accordingly.

Charges come across in the name of Dashboardanalytix.com.

When trading an account for our firm, you are treated as an independent contractor. As a result, you are responsible for any and all taxes on your gains.

Affiliates are credited for referrals when a user creates an account using a link or discount code provided by the Affiliate.

24/7 Support

Weekly Updates

Secure and Complaint

99.9% Uptime

Top1Funded Is A Proprietary Trading Firm Offering Instant Funding, Paid Evaluations, And 1-Step Or 2-Step Challenges — All With Real Payouts And No Hidden Rules. Trade Forex, Futures, Or Crypto With Flexible Plans, 24/7 Support, And A Trusted U.S.-Based Team.

Features

Disclaimer: Forex and Crypto accounts operate in a simulated trading environment with real-time market data. Futures accounts are simulated during the evaluation phase and transition to a live trading environment once funded. Performance depends on the account type and trading phase.

Top 1 Funded is an affiliate of Prop Account, LLC. All funding assessments are provided by Prop Account, LC and all assessment fees are paid to Prop Account, LLC. If you qualify for a Funded Account, you will be required to enter into a Trader Agreement with Prop Account LC. Neither Prop Account, LLC nor Prop Account LC provides any trading education or other services. All such services are provided by Top 1 Funded.