Top1funded

4.6

21 Reviews

I had a truly seamless experience with…

I had a truly seamless experience with Top1funded. The onboarding was transparent, setup was quick, and funding arrived exactly as promised. Their customer support was knowledgeable, responsive, and guided me through each step—highly recommended!

I completed the challenge and received…

I completed the challenge and received my payout within days. The entire process was smooth and hassle-free. Definitely one of the best firms I’ve worked with!

One of the most transparent and…

One of the most transparent and trader-friendly prop firms out there. The spreads are low, and they actually seem to care about your success. Highly recommended!

As Seen On

and over 250 trusted news platforms worldwide.

Trusted By 10,000+ Traders

24/7 Support

No Hidden Rules

First Payout Instantly

Based in USA

$12M in Payouts Processed and Growing

Multiple Trading Platforms.

Scale Up to $1M

Top1Funded Crypto Program

Crypto trading shouldn’t be boxed in by rigid rules and slow systems. At Top1Funded, we give you real flexibility and a serious path to get funded.

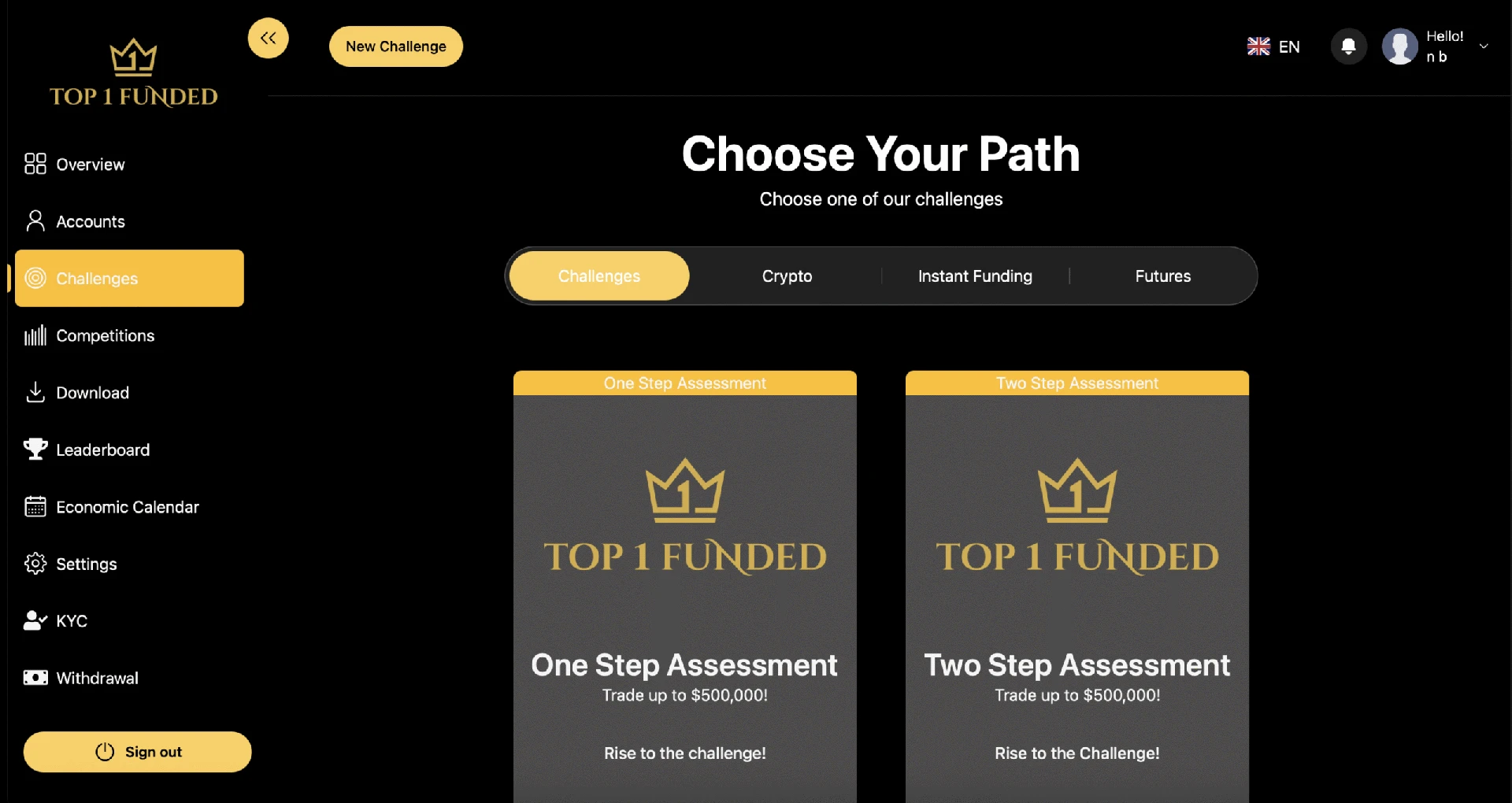

Choose between 1-step or 2-step challenges — with no minimum trading days, no consistency rules, and no strategy restrictions.

- Pass the challenge and trade crypto 24/7 with full control — no stop loss required, and no limitations on your trading style.

- Access the markets through DXtrade, our advanced crypto trading platform built for performance.

This is funding built for crypto traders who want speed, control, and guaranteed payouts — without the hidden rules.

Trade Anytime — Including Weekends

Crypto markets don’t sleep — and neither do we. keep trades open over the weekend.

1 Step and 2 Step programs

Get funded in one day.

No Strategy Restrictions

Use your own approach: scalping, swing, EAs, bots — you name it.

No Hidden Rules

No consistency rules, no surprise resets, no tricky clauses

Earn 90% of your account gains

No add ons required.

Crypto-Specific Risk Limits

5:1 leverage on BTC & ETH, 2:1 on alt coins. Plus a smart ±3% daily cap for risk protection

How It Works?

1

Choose Your Program & Account size below

2

Pass Your Evaluation

3

Trade, Withdraw, Repeat

Build Your Crypto Account

1. Select Program

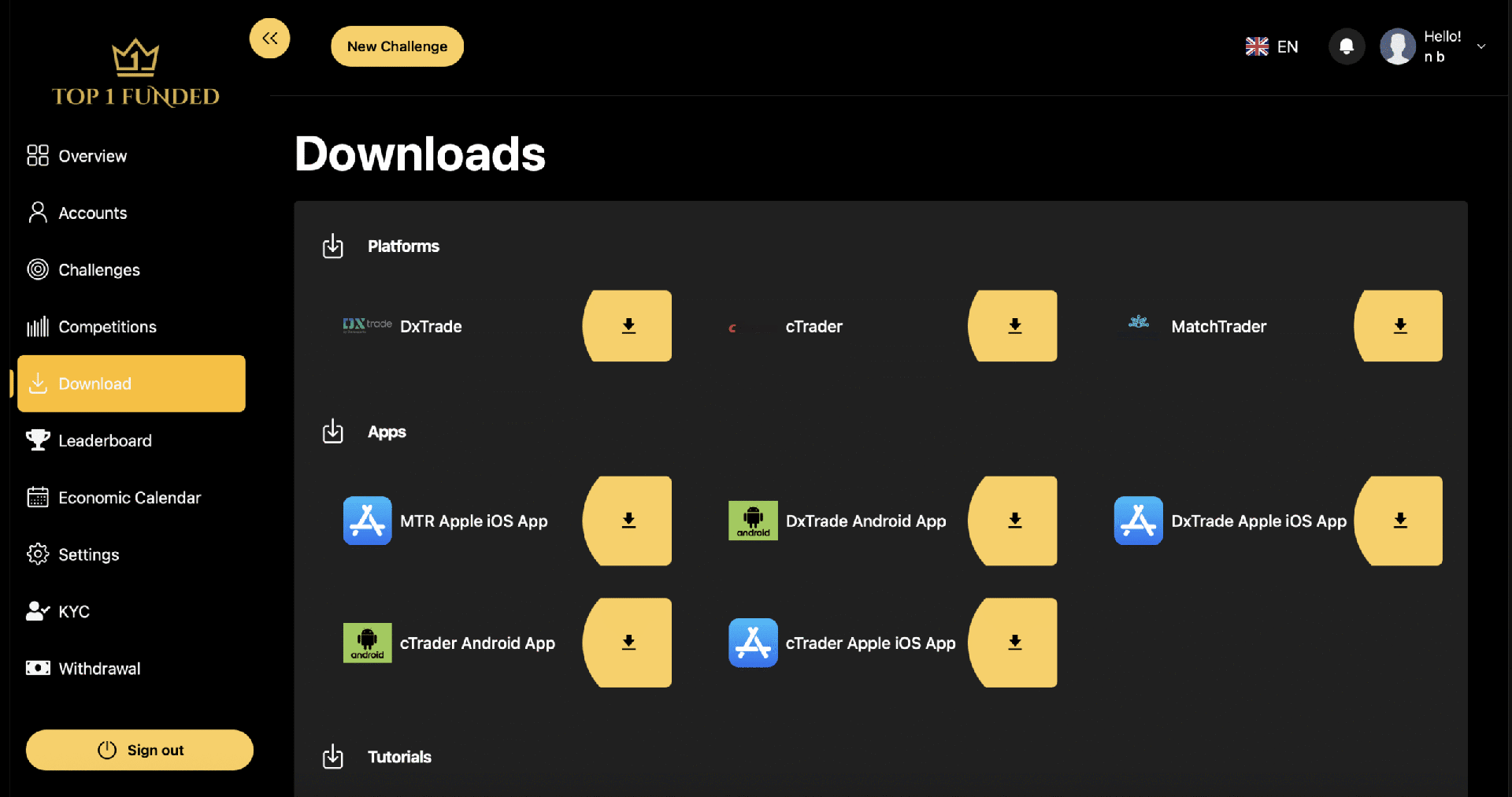

2. Select Trading Platform

3. Select Your Balance

Account Summary

Experience fast, reliable crypto execution with DXtrade — the preferred platform for serious traders who demand precision, customization, and full control over every move.

A Dashboard Built for Traders, by Traders

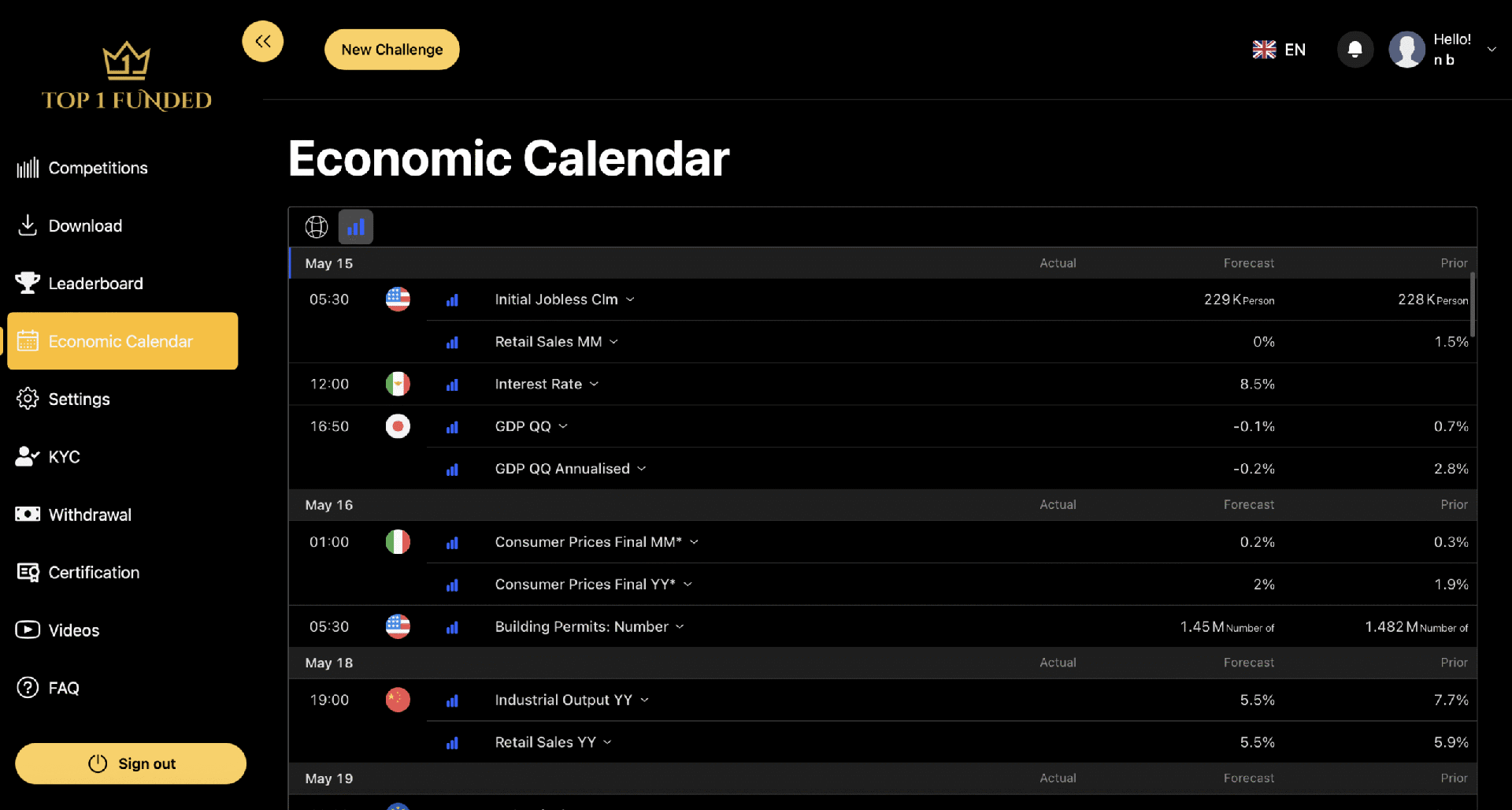

Our modern trader dashboard includes built-in economic calendars,

competition tracking, payouts, Platforms, and more — so you’re always one step ahead.

Trade 24/7 From Anywhere

Transparent

Rules

Discord & Telegram Community Access

Real payouts — On Time, Every Time

Real Human Support, Not Bots

Certificates of Withdrawal

Your Trader Knowledge Hub

Educational Blogs, Insights, And Trading Strategies To Help You Get Funded, Stay Funded, And Level Up Your Journey

TOP 1 Funded Details & FAQ

Learn more about using an Top1Funded Platform.

A breach means that you violated the Max Drawdown rule. In the event you have a breach, you will fail the Assessment or have your Funded Account taken away.

The Daily Cap Limit is the maximum percentage of your starting balance that your crypto account can move in any given day. The Daily Cap Limit is calculated using the previous day’s equity, which resets at 5 PM EST. In the event that the assets in your account move in excess of 3% of your starting balance from your previous day’s equity in either direction, your positions will be closed out and your account will be locked until the start of the new trading day at 5 PM EST. Example: For a 100k starting balance account, with a 3% Daily Cap. If the account finishes the day, with Equity at 101k, the next day’s limits will be 101k +/- 3k (i.e. 98k – 104k).

The Maximum Drawdown is initially set at 6% and is static and will therefore remain at the same value for as long as the account will remain active.

Example: If your starting balance is $100,000, you can drawdown to $94,000 before you would violate the Maximum Drawdown rule. Then for example let’s say you take your account to $102,000 in CLOSED BALANCE, your Maximum Drawdown would remain at $94,000. So, regardless of how high your account goes, your drawdown will remain the same.

Yes.

Yes. We will consider you inactive and your account will be breached if you do not have any trading activity on your account for 30 consecutive days.

Upon passing your Assessment, you will receive an email with instructions on how to access and complete both your “Know Your Customer” verification and your “Trader Agreement”. Once both are completed your Funded Account will be created, funded and issued to you typically within 24-48 business hours. You will receive a confirmation email once this account is being enabled.

Once you pass the Assessment, we provide you with a funded account, backed by our capital. The capital in your funded Account is notional and may not match the amount of capital on deposit with the Liquidity Provider. A Funded Account is notionally funded when actual funds in the account (i.e., the equity in a Funded Account represented by the amount of capital) differs from the nominal account size (i.e., the size of the Funded Account that establishes the initial account value and level of trading). Notional funds are the difference between nominal account size and actual capital in a Funded Account.

Use of notional funding does not impact your trading conditions in any way.

No. We do not have any control over pricing from the liquidity provider or on the executions on your trades.

For purposes of managing risk and minimizing transaction costs, we may offset or negate market risk and act as the direct counterparty to certain trades initiated in the Account. Such trades are executed at prices provided by the Liquidity Provider(s). This framework is intended to ensure you receive real market execution on your trades, while simultaneously allowing us to manage risk dynamically by routing existing positions or future orders to third parties for execution as we deem appropriate. We believe that such real market execution and dynamic risk management would not be possible or as cost-effective if trades were executed in simulated accounts. Regardless of whether we act as counterparty to your trades, the gain or loss on your funded account is not calculated differently. However, when we act as the counterparty to your trades, there is an inherent potential conflict of interest because your trades do not result in net gain or loss to us, as your trades would if we were not the direct counterparty.

The maximum position that you may open is determined by your available margin. We reserve the right to increase the margin requirement, amend the leverage ratio limits, or limit the number of open positions you may enter or maintain in a Funded Account at any time, without prior notice, and to revise, in response to market conditions, the drawdown levels at which trading in the funded account will be halted. We or the Liquidity Provider reserve the right to refuse to accept any order.

The rules for the funded account are exactly the same as your Assessment account. However, with a funded account, there is no profit target.

If you have gains in your funded account at the time of a breach, you will still receive your portion of those gains.

For example, if you have a $100,000 account and you grow that account to $110,000. Should you then have a breach we would close the account. Of the $10,000 in gains in your funded account, you would be paid your portion thereof.

Traders can request a withdrawal of the gains in their funded account at any time in their trader dashboard, but no more frequently than once per thirty (30) days. So, if you make gain in your funded account, you can request a withdrawal. When you are ready to withdraw the gains from your funded account, click the Withdraw Profits button in your trader dashboard and enter the amount to withdraw. All such gains are distributed via the available outbound payment solutions offered from time to time. Once your withdrawal request is approved, we will pay the monies owed to you. We reserve the right to change the withdrawal methods and options at any time.

Your first withdrawal can be requested at any time, subject to the profit split stated in the Trader Agreement. Thereafter, you can request a withdrawal of the gains in your account every 30 days. When a withdrawal is approved, we will also withdraw our share of the gains. The drawdown does not reset when you request a withdrawal. Example: You have taken an account from $100,000 to $120,000. You then request a withdrawal of $16,000 where the profit split is 90/10. In this scenario, you will receive $14,400 and we would retain $1,600. This would also take the balance of the account down to $104,000, and your Maximum Drawdown will remain$94,000. So, you would have $10,000 maximum you could lose on the account before it would violate the Maximum Drawdown rule. If you take a full withdrawal of the gains in your Funded Account, the Maximum Drawdown will still remain at $94,000.

We have risk management software that is synced with the accounts we create. This allows us to analyze your performance in real time for achievements or rule violations. As such, you must use an account that we provide to you.

Subject to compliance with applicable laws and regulations, traders from all countries, excluding OFAC listed countries, can take part in our program, unless otherwise limited at the Company’s discretion.

You must be at least 18 years of age, or the applicable minimum legal age in your country, to purchase an assessment.

Upon purchasing an Assessment, you will receive access to a trader dashboard where you can monitor your Assessment and Funded Accounts. The dashboard is updated every time we calculate metrics, which occurs roughly every 60 seconds. It is your responsibility to monitor your breach levels.

All trades will be executed on the DXtrade platform.

You can trade any products streamed by the Liquidity Provider into the available platform.

We allow up to 5:1 leverage on BTC and ETH. Other cryptocurrencies listed on the platform are at 2:1.

Trading hours are set by the cryptocurrency exchange or Liquidity Provider(s) and are generally open 24 hours. We do not have any control over the trading hours.

Please note that holidays can have an impact on available trading hours.

Commissions or commission-equivalents may be charged in connection with your trading activity. Note that cryptocurrency trading is subject to a percentage-based commission rate of 0.05% of the total notional trade volume, charged per side (USD amount * 0.0005).

DXTrade does not support automated strategies.

You are also prohibited from using any trading strategy that is expressly prohibited by the Company or the Liquidity Providers it uses. Such prohibited trading (“Prohibited Trading”) shall include, but not be limited to:

- Exploiting errors or latency in the pricing and/or platform(s) provided by the Liquidity Provider

- Utilizing non-public and/or insider information

- Front-running of trades placed elsewhere

- Trading in any way that jeopardizes the relationship that the Company has with a Liquidity Provider or may result in the canceling of trades

- Trading in any way that creates regulatory issues for the Liquidity Provider

- Utilizing any third-party strategy, off-the-shelf strategy or one marketed to pass challenge accounts

- Utilizing one strategy to pass an assessment and then utilizing a different strategy in a funded account, as determined by the Company at their discretion.

- Attempting to arbitrage an assessment account with another account with the Company or any third-party company, as determined by the Company in its sole and absolute discretion.

- If the Company detects that your trading constitutes Prohibited Trading, your participation in the program will be terminated and may include forfeiture of any fees paid to the Company. Additionally, and before any Trader shall receive a funded account, the trading activity of the Trader under these Terms and Conditions shall be reviewed by both the Company and the Liquidity Provider to determine whether such trading activity constitutes Prohibited Trading. In the case of Prohibited Trading, the Trader shall not receive a funded account.

- Additionally, the Company reserves the right to disallow or block any Trader from participating in the program for any reason, in the Company’s sole and absolute discretion.

To view all Prohibited Uses, please review our Terms and Conditions here, https://dashboardanalytix.com/client-terms-and-policies/?v=3acf83834396

Opening a position within 3 minutes before or after a News Event is prohibited. Any traders identified as having opened a position during a News Event are subject to having that position closed and the associated P&L removed from their account, having the leverage on their account reduced or having their account breached altogether. The Company has sole and absolute discretion in determining what constitutes a News Event. This rule is intended to protect the integrity of our program and is not meant to penalize traders who inadvertently trade through a news event.

Charges come across in the name of dashboardanalytix.com.

When trading a Funded Account for our firm, you are treated as an independent contractor. As a result, you are responsible for any and all taxes on your gains.

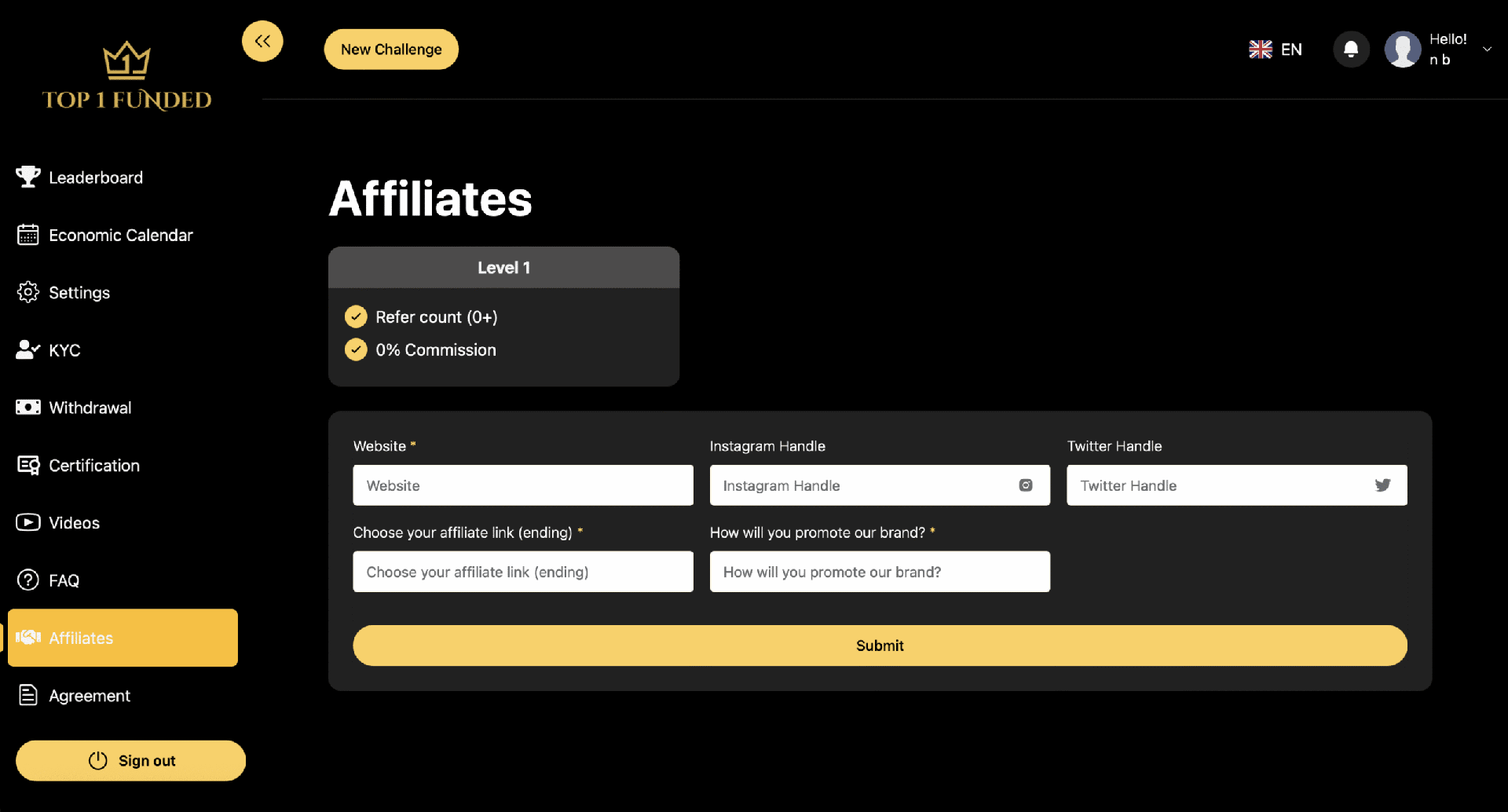

Affiliates are credited for referrals when a user creates an account using a link or discount code provided by the Affiliate.

24/7 Support

Weekly Updates

Secure and Complaint

99.9% Uptime

Top1Funded Is A Proprietary Trading Firm Offering Instant Funding, Paid Evaluations, And 1-Step Or 2-Step Challenges — All With Real Payouts And No Hidden Rules. Trade Forex, Futures, Or Crypto With Flexible Plans, 24/7 Support, And A Trusted U.S.-Based Team.

Features

Disclaimer: Forex and Crypto accounts operate in a simulated trading environment with real-time market data. Futures accounts are simulated during the evaluation phase and transition to a live trading environment once funded. Performance depends on the account type and trading phase.

Top 1 Funded is an affiliate of Prop Account, LLC. All funding assessments are provided by Prop Account, LC and all assessment fees are paid to Prop Account, LLC. If you qualify for a Funded Account, you will be required to enter into a Trader Agreement with Prop Account LC. Neither Prop Account, LLC nor Prop Account LC provides any trading education or other services. All such services are provided by Top 1 Funded.